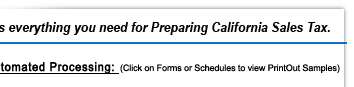

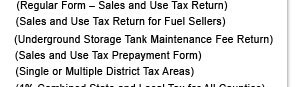

GUIDE TO PREPARE A SALE AND USE TAX RETURN

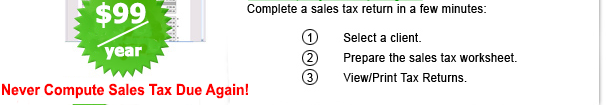

NEVER COMPUTE SALES TAX DUE AGAIN!

|

| On Sales Tax Calculator worksheet: |

In-store Sales: Single location (401-EZ or 401-A)  |

| |

• |

Enter retail merchandise sales including tax on line R1. |

| |

• |

Or taxable sales without tax on line 12. |

| |

• |

Add nontaxable sales and other nontaxable deductions on line 4-8 & 10. |

|

Vending Machine Operators: (401-A or 401-GS + Vending)  |

| |

• |

Open Vending worksheet from Sales Tax Calculator worksheet. |

| |

• |

Just enter Total sales including tax on each type of vending sales such as Food Sales 100% taxable sales, 33% taxable sales... on worksheet. |

|

Chain stores or chain restaurants. Multiple locations. (401-A + sub-outlets)

Having 2 or more sales locations?. |

| |

• |

Just enter retail merchandise sales including tax on line R1, |

| |

• |

Add nontaxable sales and other nontaxable deductions on line 4-8 & 10 for each location. |

|

Gas station. (401-GS) single or 2+ locations (401-GS + sub-outlets) (with Vending).  |

| |

• |

Enter retail merchandise sales including tax on line R1. |

| |

• |

Add non taxable sales and other nontaxable deductions on line 4-8 & 10. |

| |

• |

Add MV fuels including tax, Diesel fuels including tax. |

| |

• |

Enter gallons of Diesel fuels sold (State excise taxes are exempt from sales tax). |

| |

• |

Enter gallons of Motor Vehicle fuels and Diesel fuels bought (Get credit for sales tax prepaid to fuel suppliers). |

| |

• |

Enter tax prepayments paid for the tax period. You are done! |

|

A trade show business with multiple district tax areas sales. (401-A + Sch. A & B).

Having one permanent location and multiple district area sales? |

| |

• |

Just enter Total taxable sales without tax on line 1-Total (gross) sales on main worksheet. |

| |

• |

Enter taxable sales without tax for each city or county on Schedule A worksheet. |

|

| After you entered the above sales transactions. Stop! You are done. |

| |

• |

CSUTax will calculate and transfer all sales data and applicable sales tax and tax due to tax form and its schedules based on business's city & zip code and tax periods. |

|

| On Sales Tax Calculator worksheet: |

| |

° |

Click "Print" to view/print the worksheet. |

| |

° |

Click "Transfer data to main worksheet" to view/print a tax return. |

|

| Now you have 2 options to file your sale tax returns: |

| On main worksheet: |

| |

1. |

File online: Click "E-filing Report" to print a report and use it to transfer line by line to BOE E-filing online. |

| |

2. |

File paper tax forms: Click "View/Print Tax Return" to have paper tax forms to send it to BOE. |

|

|

|